Census Finds Insurance Crisis Continues to Grow in U.S.

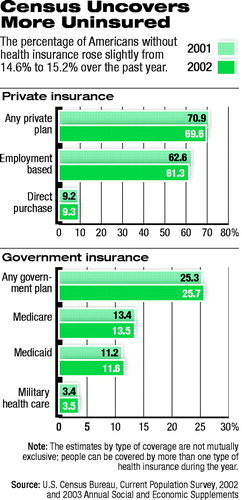

A report issued by the U.S. Census Bureau on September 29 states that an estimated 43.6 million people, or slightly more than 15 percent of the population, were without health insurance coverage during the entire year of 2002.

This figure represents an increase of 2.4 million uninsured people, or 14.6 percent, over 2001, the largest increase in a decade.

According to the report, the decrease came about largely because of a drop in the number and percentage of people covered by employer-based insurance. For the second straight year, the proportion of people who received insurance through an employer declined, from 62.6 percent in 2001 to 61.3 percent in 2002.

The number of people with such coverage declined by 1.3 million over the two-year period. Census Bureau data show that in 2002 17 percent of the uninsured worked full time, and 24 percent of them worked part time.

What brought about the decrease in employer-based coverage? From the report, it is impossible to conclude whether it was due to decisions by employers or by employees to drop coverage or by a combination of the two. A third potential cause is the overall increase in unemployment.

Kate Sullivan, director of health care policy at the U.S. Chamber of Commerce, was quoted in the September 30 Washington Post as saying, “Employment-based coverage is getting really expensive. Either the company doesn’t make it available or individuals are turning down coverage at work because they can’t afford it.”

Earlier, on September 9, the Kaiser Family Foundation and the Health Research and Educational Trust (KFF/HRET) released the 2003 Annual Survey of Employer Health Benefits (see story on Original article: page 5).

That survey reported that between spring 2002 and spring 2003, monthly premiums for employer-sponsored insurance rose 13.9 percent, the third consecutive year of double-digit premium increases and the highest premium increase since 1990.

Premiums increased considerably faster than the rate of inflation, which was 2.2 percent in that time period.

Fifty-one percent of large-firm (200 employees and above) employers reported that they were “very likely” to increase the amount employees pay for health insurance next year. Three percent of such employers planned to restrict employee eligibility for coverage, and 1 percent expected to drop coverage entirely.

Government health insurance programs, particularly Medicaid, helped prevent an even greater spike in the number of uninsured. The number and percentage of people covered by such programs rose from 25.3 percent in 2001 to 25.7 percent in 2002 (see chart).

Government health insurance programs, particularly Medicaid, helped prevent an even greater spike in the number of uninsured. The number and percentage of people covered by such programs rose from 25.3 percent in 2001 to 25.7 percent in 2002 (see chart).

The enrollment rate for Medicaid coverage went from 11.2 percent to 11.6 percent of the population, while the Medicare enrollment rate decreased by .1 percent to 13.4 percent.

Medicaid itself, however, is under severe cost-containment pressures because of state and federal fiscal constraints (see story on page 9). Every state cut Medicaid costs in some fashion in Fiscal 2003, and all plan additional cuts for Fiscal 2004.

The two most frequently used strategies for cost containment in 2003 were “controlling drug costs” and “reducing/freezing provider payments.” Only 18 states made efforts to save money by restricting eligibility, but as the possibility for savings through other means becomes exhausted, states might impose restrictions on enrollment that will further increase the number of uninsured.

Selby Jacobs, M.D., told Psychiatric News, “The rise in the number of uninsured in the United States, now biting into the working and middle classes of American society, could not come at a worse time. Not only does it aggravate the problem of access to care, the ‘cushion’ that Medicaid usually provides in these circumstances is compromised by the fiscal plight of the states. The convergence of the two problems creates a crisis in access to care that affects not only the poor but a broad sweep of Americans.”

Jacobs is chair of APA’s Committee on Public Funding of Psychiatric Services, director of the Connecticut Mental Health Center, and a professor of psychiatry at Yale University School of Medicine in New Haven.

“Health Insurance Coverage in the United States: 2002” is posted on the Web at www.census.gov/prod/2003pubs/p60-223/pdf. “2003 Employer Health Benefits Survey” is posted at www.kff.org/content/2003/3369. ▪