Is Slowing Health Care Spending a Trend or Anomaly?

The growth of the nation's health care spending slowed in 2007 to its lowest rate in nearly a decade, according to recently released data—but the reduction in the growth of spending is likely to be temporary.

Health care spending by both the private and public sectors increased by only 6.1 percent in 2007 and totaled $2.2 trillion (or $7,421 per person), according to a report by the Centers for Medicare and Medicaid Services' (CMS) Office of the Actuary. In the preceding year, the growth rate was 6.7 percent over that of 2005.

The spending estimates are based on an analysis of government data, including Medicare and Medicaid information, health care provider surveys, and private health insurance filings with state insurance commissioners.

The latest government data showed that health care expenditures rose to 16.2 percent of the gross domestic product in 2007, up from 16 percent in 2006.

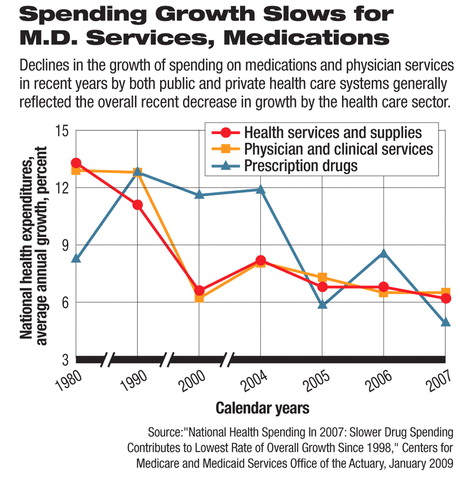

The slower growth was largely attributed to reduced retail prescription drug spending and slowed government spending on health care. Physician payments also showed slower growth. Most other types of health care services either grew at about the same rate as in 2006 or faster.

More than half of the slowed growth in spending was attributed to decreased spending on prescription drugs, which made up 10 percent of all health care spending in 2007. In that year, retail prescription drug spending grew by just 4.9 percent to $227.5 billion, which was a deceleration from its 8.6 percent growth in 2006. The yearly average growth in spending on medication was 9.4 percent from 2001 to 2006, according to the study, led by Micah Hartman, a statistician for the CMS Office of the Actuary.

Hartman and his coauthors attributed the drop in medication outlays to increased use of lower-cost generic drugs, slower growth of drug prices, and safety concerns that have decreased sales of some medications.

The increased use of typically cheaper generic versions of medications by patients is a behavior that has been encouraged by insurers. Generic drugs cost 30 percent to 80 percent less, on average, than their brand-name counterparts, the authors noted.

Some grocery-store chains and large retailers also have contributed to the lower-spending trend by offering customers generic-drug discount programs. Another factor in drug price reductions may be the loss of patent protection in 2006 by several top-selling brand-name drugs, which allowed generic competitors to enter the market

The increasing role of generics is not likely to become an annual occurrence, said Richard Foster, CMS chief actuary, in a press conference.

“I wouldn't expect the good news to continue,” Foster said.

On another front, insurers lowered copayments for certain drugs but raised them for other drugs, some of which companies may want consumers to avoid for safety as well as financial reasons. Consider: the Food and Drug Administration mandated 68 black-box safety warnings on drug labels in 2007, compared with 58 warnings in 2006 and 21 in 2003, according to the CMS report.

Another area where growth slowed was payment to physicians—representing 18 percent of health care outlays. Payments grew by 5.9 percent, compared with an increase of 6.4 percent in 2006, according to the report. The authors attributed this slowdown, at least in part, to a reduction in physician reimbursements for “imaging services” that went into effect in 2007.

CMS officials welcomed the slower growth in the cost of health care but warned that the relative lull was not expected to continue, as long-term trends indicate costs will continue to outstrip the rate of inflation and wage increases far into the future.

“This report—like the reports issued last year on the financial status of Medicare and Medicaid—is a stark reminder that we must redouble our ongoing efforts to reform the delivery of health care services in this country to bring about the goal of affordable, high quality health for all Americans,” said Kerry Weems, CMS acting administrator, in a written statement.

Out-of-pocket spending by patients increased by 5.3 percent in 2007 to $268.6 billion, which compared with an increase of 3.3 percent in 2006, the CMS analysts found.

However, the cost of private health insurance premiums rose 6 percent in both 2006 and 2007, which was less than in many previous years such as the 10.7 percent increase in 2002. The auditors linked the slower growth rate to fewer small employers offering health coverage and increasing enrollment in health savings accounts and in high-deductible health plans.

Spending growth continued in other areas of health care, including payments to hospitals. Such spending—31 percent of health care outlays—increased by 7.3 percent in 2007, compared with an increase of 6.9 percent in 2006, the report stated.

Public spending on health care grew faster than spending by employers and other private sources in recent years, according to the report. Local, state, and federal governments paid for a larger portion of the nation's health care in 2007. Such spending comprised 46.2 percent of total health care outlays, an increase from 45.3 percent in 2004.

The federal auditors linked the increase in government health care spending to changes in Medicare, including the rising cost of the Medicare prescription drug benefit. That program's cost rose from $40.5 billion in 2006 to $47.6 billion in 2007.

Medicare spending continued to increase overall by 7.2 percent to $431.2 billion in 2007. That was a smaller increase than the 18.5 percent jump in 2006, which largely was a one-time result of costs associated with implementing the Medicare Part D program.

Medicaid spending in 2007 increased by 6.4 percent to $329.4 billion, the report found. The jump in Medicaid spending followed growth of 1 percent in 2006—due in part to loss of dual-eligible enrollees to Medicare Part D. However, the 2007 increase was credited as the main driver in rising overall state and local health spending that now accounts for about 24 percent of all state and local budgets.

“National Health Spending In 2007: Slower Drug Spending Contributes to Lowest Rate of Overall Growth Since 1998,” is posted at<http://content.healthaffairs.org/cgi/content/abstract/28/1/246>.▪