Medicare’s Managed Care Option Falls Short of Promise

Health care analyst Marsha Gold gave Medicare+Choice (M+C) a grade of “D if not an F” in “Medicare+Choice: An Interim Report Card,” an article in Health Affairs (July-August, 2001).

Gold, who is a senior fellow at Mathematica Policy Research, concludes that although “the aim of M+C was to expand choice, the choices available to Medicare beneficiaries have diminished since its inception.”

The program was authorized by the Balanced Budget Act (BBA) of 1997 with the intent of expanding health care options to Medicare beneficiaries by savings generated through what advocates assumed would be the efficiencies of managed care. Those savings were to be used to reduce premiums to beneficiaries or to offer benefits such as prescription drugs that are not available under the traditional Medicare program.

With the BBA, Congress also tried to address geographic and other inequities in access to plans offered by private insurance companies, which can offer more generous benefits than traditional Medicare. The legislation expanded the number of private plans that could participate in Medicare and introduced a new payment mechanism intended to reduce variability in payment rates across markets.

Prior to the BBA, payments to risk plans in a given county were set at 95 percent of the average fee-for-service costs of Medicare beneficiaries in that county. The BBA set payments at the maximum of a floor rate, a minimum update applied to the previous year’s rate, and, subject to a so-called budget neutrality factor, a blend of local and national rates.

Exodus From M+C

On the most basic measure of choice, access to a managed care plan, M+C’s record has never lived up to expectations and now shows deterioration from the period before the BBA was enacted. Although enrollment in Medicare managed care had been growing rapidly before passage of the BBA, it slowed after the law took effect and has now reversed (see chart).

On the most basic measure of choice, access to a managed care plan, M+C’s record has never lived up to expectations and now shows deterioration from the period before the BBA was enacted. Although enrollment in Medicare managed care had been growing rapidly before passage of the BBA, it slowed after the law took effect and has now reversed (see chart).

In 1999, Gold found that 97 plans either withdrew or reduced their service areas, affecting 407,000 enrollees. In 2000, 99 plans withdrew, affecting 327,000 enrollees. That figure nearly tripled in 2001 when withdrawals and service-area reductions affected an estimated 934,000 enrollees.

The decrease in choice among plans has been accompanied by higher premiums and reduced benefits. The decline in the percentage of beneficiaries having access to plans that do not charge a premium has been particularly pronounced, falling from 61 percent in 1999 to 39 percent in 2001.

Nor has M+C been successful in expanding access to the underserved rural areas of the country. Gold reports that in 2000, fewer than 2 percent of rural beneficiaries were enrolled in M+C, and of those, 89 percent lived in rural counties adjacent to urban areas.

Congress has acted twice to block the wave of plan withdrawals, according to testimony last April of Murray N. Ross, executive director of the Medicare Payment Advisory Commission, before the U.S. Senate Finance Committee. Most recently, the Benefits Improvement and Protection Act of 2000 raised the floor of payments, introduced a separate and higher floor for urban counties, and provided for a minimum update of 3 percent to 2001 payment rates.

What’s the Solution?

Few would disagree that federal money (or lack thereof) is somewhere at the heart of problems in finding effective ways to deliver medical services to the elderly, but what form that delivery mechanism should take remains controversial.

The Government Accounting Office (GAO), for example, claims that Medicare spends more money on beneficiaries enrolled in managed care programs than in those enrolled in the traditional Medicare program. That agency was asked by Congress to determine whether program spending for M+C enrollees had exceeded what Medicare-covered care for those beneficiaries would have cost in the fee-for-service (FFS) program and the extent to which payments between the two types of coverage differed.

The study, which was published in August 2000 and used 1998 data, echoed the conclusions of other GAO studies that found that Medicare spent more on beneficiaries enrolled in managed care plans. GAO surmised that the reason for the disparity is that Medicare’s payment method “did not adequately account for the fact that “[M+C] health plans tended to attract a disproportionate number of healthier-than-average beneficiaries with lower-than-average health care costs.”

In the August 2000 study, GAO refuted insurance company allegations that the earlier studies conducted by GAO were invalid because the mix of beneficiaries had changed. The report concludes that Medicare “aggregate payments to Medicare+Choice plans in 1998 were about $5.2 billion (21 percent), or approximately $1,000 per enrollee, more than if the plans’ enrollees had received care in the traditional FFS program.” It is “these excess payments and not managed care efficiencies” that enable M+C plans to offer more comprehensive benefits with a small or no premium.

Opinions Differ

Chester W. Schmidt Jr., M.D., chair of APA’s Committee on RBRVS, Codes, and Reimbursements, told Psychiatric News, “That conclusion is absolutely wrong. Rather than attracting healthier beneficiaries, M+C attracts those with more severe health problems who need the greater range of benefits. The federal government did not anticipate the true cost of providing medical services.”

Schmidt was president of Johns Hopkins Bayview Physicians in 1997 when his Faculty Practice Plan accepted a capitated risk contract from Blue Cross/Blue Shield to participate in Maryland’s M+C plan.

“During the four years we were in the M+C program, we lost over $3 million on the risk contract,” he said. Kaiser Permanente is the only company in Maryland that still participates in M+C, according to Schmidt.

Edward Gordon, M.D., chair of APA’s Medicare Advisory Committee, supports GAO’s conclusions and said, “If managed care companies lose money on M+C contracts, it is because their administrative costs exceed administrative costs for traditional Medicare. The cost of managing the care greatly exceeds the projected savings. Initial managed care savings resulted from discounts imposed on health care professionals by the companies.”

What’s Next?

Any attempt to stem the flood of plan withdrawals by increasing payments to insurance companies could be defeated by a more intractable force: escalating costs in the Medicare program. Last July, U.S. Comptroller General David Walker told the Committee on the Budget of the House of Representatives that in the first eight months of 2001, Medicare spending was 7.5 percent higher than in the previous year.

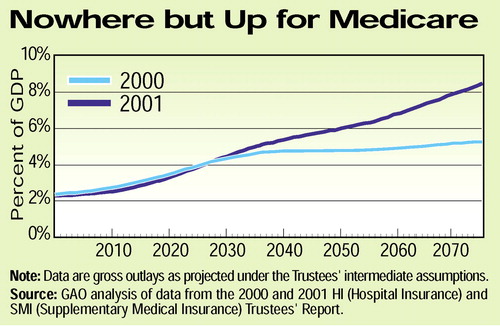

Even more serious is the fact that Medicare spending “is likely to grow faster than previously estimated,” according to Walker. The Medicare trustees are now projecting that Medicare costs will eventually grow at 1 percentage point above per-capita gross domestic product (GDP) each year, about 1 percentage point faster than had been originally projected. Under this new assumption, Medicare spending would consume 5 percent of GDP by 2035. When costs of Medicaid are added to those of Medicare, the percentage climbs to about 8. By comparison, the percentage of the GDP for the two programs now is 3.5 (see chart).

Even more serious is the fact that Medicare spending “is likely to grow faster than previously estimated,” according to Walker. The Medicare trustees are now projecting that Medicare costs will eventually grow at 1 percentage point above per-capita gross domestic product (GDP) each year, about 1 percentage point faster than had been originally projected. Under this new assumption, Medicare spending would consume 5 percent of GDP by 2035. When costs of Medicaid are added to those of Medicare, the percentage climbs to about 8. By comparison, the percentage of the GDP for the two programs now is 3.5 (see chart).

The Web site for Project Hope, which publishes Health Affairs, is www.projecthope.org/CHA. The Web site for Mathematica Policy Research, which has a project monitoring Medicare+Choice, is www.mathematica-mpr.com. The Medicare Payment Advisory Commission’s Web site is www.medpac.gov. ▪