PBMs Face Lawsuit Over Pricing Policies

The Prescription Access Litigation (PAL) project and the American Federation of State, County, and Municipal Employees (AFSCME) announced that they have filed suit against the nation’s four largest pharmacy benefit managers (PBMs) for inflating prescription drug prices, according to a March 18 press release.

The four companies, Advance PCS, Express Scripts, MedCo Health Solutions, and Caremark Rx, control more than 80 percent of the PBM market.

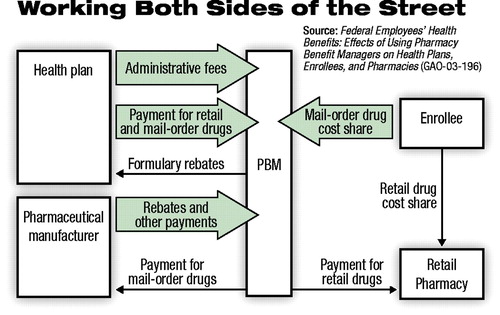

AFSCME senior negotiator Steve Kreisberg said in the press release, “It now appears that the biggest players in the PBM industry, whom we once thought of as allies in our fight to control drug costs, have been working both sides of the street.”

He noted that health care issues are the most difficult to resolve at the bargaining table because of skyrocketing costs, particularly those of prescription drugs (Original article: see box).

According to the court filing, PBMs were first established in the 1970s to provide health plans with a more-efficient and less-expensive means of managing their members’ prescription drug benefits, particularly the processing of pharmaceutical claims.

By 2001 nearly 200 million Americans had their prescription drug benefits managed by a PBM, according to the General Accounting Office (GAO).

In its January report, “Federal Employees’ Health Benefits: Effects of Using Pharmacy Benefit Managers on Health Plans, Enrollees, and Pharmacies” (GAO-03-196), the GAO includes a chart that provides an overview of sources of payment to PBMs (see diagram below).

In its January report, “Federal Employees’ Health Benefits: Effects of Using Pharmacy Benefit Managers on Health Plans, Enrollees, and Pharmacies” (GAO-03-196), the GAO includes a chart that provides an overview of sources of payment to PBMs (see diagram below).

PBMs negotiate price discounts with retail pharmacies and rebates with manufacturers and operate mail-order prescription services and administrative claims-processing systems. They also develop and manage preferred-drug lists and establish procedures for drug utilization reviews.

The suit charges violation of California’s Unfair Competition Law by “failing to disclose material facts in the conduct of trade or commerce. . . .”

Specific allegations are that the defendants have made misrepresentations by claiming that the average wholesale price (AWP) “is an accurate reflection of the average wholesale price paid for their drugs when AWP is, in reality, a fictitious and inflated amount.”

AWPs, which are used to establish reimbursement rates for drugs, are published in various print and electronic media such as Drug Topics Red Book.

The suit claims that “drug manufacturers often deliberately and intentionally published AWPs for drugs that did not reflect the actual pricing structure of the drugs. . . .The PBMs. . .would bill patients and their insurers at the inflated AWPs and earn a substantial profit from the ‘spread’ between the real cost and the various AWP-related reimbursement rates.”

The suit also alleges another kind of “secret spread” that results in higher costs to health plans. According to the complaint, health plans might be charged the AWP minus 13 percent, but the retail pharmacy might only receive the AWP minus 15 percent, generating an undisclosed 2 percent spread for the PBM.

The suit claims “fraudulent conduct” because the defendants allegedly “prevented government-funded or -maintained health plans and consumers from knowing what the actual rebates, spreads, and other payments were.”

PBMs Deny Charges

Dale Thomas, spokesperson for Advance PCS, said the company believes there is “no merit” to the case. “In addition,” he said, “the terms of our business relationships with clients are determined by a highly competitive bidding process.”

Express Scripts noted that it does not comment on the specifics of legislation, but made points about business practices.

“Express Scripts enables each client receiving rebate (manufacturer discount)revenue to audit its rebate revenue. . .[the company]has been phasing out manufacturer funding for drug-specific education programs. . .the payments will be completely phased out by October 1, 2003.”

MedCo Health Solutions and Caremark RX had not responded by press time.

In a related case, California Attorney General Bill Lockyer filed a suit alleging that pharmaceutical companies Abbott Laboratories Inc., Wyeth Inc., and Wyeth Pharmaceuticals “defrauded California’s Medicaid Program (known as Medi-Cal) by reporting excessively high prices for some of their prescription drugs.”

Lockyer filed the complaint (Case No. BC 287198A) in the Superior Court of California on January 7, charging violations of California’s False Claims Act, which provides the opportunity to award treble damages and penalties of up to $10,000 per false claim.

Medi-Cal reimburses clinicians based on the estimated acquisition cost (EAC) for a drug. The EAC can be based either on the product’s AWP or, as is the case with Abbott and Wyeth, the direct price (DP) reported by manufacturers.

The DP is supposed to represent the price at which Abbott and Wyeth are selling their products to pharmacies or end distributors without a wholesaler being involved in the transaction.

According to the press release announcing the action, California’s complaint resulted from a whistleblower lawsuit filed by a small pharmacy, Ven-A-Care, which gathered data on the discrepancies between the actual prices it was paying to manufacturers and prices reported to Medi-Cal.

The complaint alleges, for example, that Ven-A-Care paid $11.20 for a 10-ml dose of the sedative Ativan, manufactured by Wyeth, while the Medi-Cal program paid $70.19.

According to the complaint, Abbott engaged in the illegal pricing activities beginning on or before January 1, 1988, through June 1, 2001, at which time the company reduced its reported prices. Wyeth’s illegal pricing activities began at the same time and were continuing at the time the complaint was filed, the attorney general alleges.

A spokesperson for Abbott said, “Abbott has properly and lawfully provided information to the government and to the independent drug reporting services on which the government relies in setting reimbursements.”

Wyeth did not reply to a request for comment.

Good News or Bad?

In its report on the effect of PBMs on enrollees of the Federal Employees Health Benefits Program (FEHBP), the GAO found that PBMs had produced savings by obtaining drug discounts from retail pharmacies, dispensing drugs at lower costs through mail-order pharmacies, passing on some drug rebates, and operating drug utilization programs.

The average price that PBMs obtained from retail pharmacies for 14 brand-name drugs was about 18 percent below the average price paid by customers without third-party coverage.

The PBMs did not supply the GAO with information about the size of rebates they negotiated, however, so it is impossible to determine how much of the rebate savings were directed to company profits and how much to health plans and employees.

Anthony D’Agostino, M.D., chair of the Subcommittee on Pharmacy Benefits Management of APA’s Managed Care Committee, told Psychiatric News, “Certainly, it seems appropriate that the American public be provided enough information about the size of the rebates negotiated by the PBMs to determine whether they represent a genuine benefit to people needing prescription drugs.”

Finally, the report does not consider the potential for cost shifting to the uninsured. In 2001 about 16 percent of all prescriptions were purchased by consumers who paid the entire cost without any third-party coverage, according to the GAO report.

D’Agostino said, “It would be horrifying to think that the PBM profits generated by the rebates would be subsidized by high prices to those who can least afford to pay them: the uninsured.”

The report, “Federal Employees’ Health Benefits: Effects of Using Pharmacy Benefit Managers on Health Plans, Enrollees, and Pharmacies,” can be accessed on the Web at www.gao.gov/ by searching on the report number, GAO-03-196. ▪