Insurance Regulation Could Do More Harm Than Good

Regulation of health insurance premiums alone is not likely to stem rising costs if efforts are not made to address the root causes of health care inflation: ever-expanding medical technology in the face of limited resources to pay for it.

In the absence of such efforts, merely capping insurance premiums is likely to have a number of unintended negative consequences.

That is the conclusion from an analysis by the California HealthCare Foundation of a proposal in California that would have required premium increases to be approved by the state.

Under the Health Insurance Cost Control Legislation (SB 26) introduced in 2003, health plans would have been required to reimburse policyholders with interest for premium increases imposed between April 1, 2000, and January 1, 2004, unless the increases were approved retroactively by the Department of Insurance or the Department of Managed Health Care.

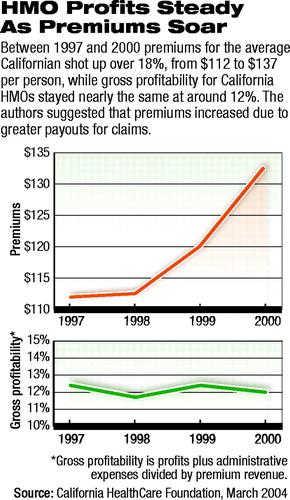

The bill did not pass out of committee last year, but rising health care costs and increasing profits for some health plans have fueled a movement in the state for premium regulation.

“Private HMO and health insurance premiums in California are soaring,” according to a statement supporting SB 26 last year by the California Health Consensus, a coalition of physicians and others who favor universal health care. “Small businesses have seen their premiums escalate close to 20 percent each year for three years. Concurrently, some HMOs and insurers are enjoying double- and triple-digit profit increases, have amassed cash reserves not counted as profit but that are $2.2 billion above the guidelines adopted by the Department of Managed Health Care (DHMC), and spend up to 33 cents of every health care dollar not on care but on administration, salaries, and advertising.”

“Private HMO and health insurance premiums in California are soaring,” according to a statement supporting SB 26 last year by the California Health Consensus, a coalition of physicians and others who favor universal health care. “Small businesses have seen their premiums escalate close to 20 percent each year for three years. Concurrently, some HMOs and insurers are enjoying double- and triple-digit profit increases, have amassed cash reserves not counted as profit but that are $2.2 billion above the guidelines adopted by the Department of Managed Health Care (DHMC), and spend up to 33 cents of every health care dollar not on care but on administration, salaries, and advertising.”

However, in a recent report titled “Should California Regulate Health Insurance Premiums?,” the California Health Care Foundation states that premium regulation would do little to address the root causes of inflation of health care costs. And if health care costs continue to rise while premiums are frozen, several negative consequences would likely ensue. According to the foundation, they include the following:

• In the short term, insurers could balance their losses by reducing the quality or quantity of care—or both.

• Insurers could discourage unhealthy consumers from enrolling in plans, thus increasing the number of uninsured over time.

• Insurers may exit the market entirely.

• Over the longer term, regulation could discourage expensive treatments and technologies, no matter how beneficial, from coming to market.

On the plus side, the foundation noted that a desirable related consequence is that premium regulation could motivate the introduction of cost-saving technologies.

“We’ve determined that SB 26 would limit premium growth in the short run,” said Neeraj Sood, associate economist at RAND and lead author of the report. “However, without modification, it would do little to cure the root causes of health care inflation.”

The other authors of the report were Abby Alpert, research assistant at RAND; Dana Goldman, Ph.D., director of health economics at RAND; and Mary Vaina, director of communications at RAND.

The California HealthCare Foundation is an independent, nonprofit organization that commissions research and analysis, publishes and disseminates information, convenes stakeholders, and funds development of programs and models aimed at improving the health care delivery and financing systems. The foundation focuses on four areas of health care: chronic disease care, hospital care, health insurance, and public financing and policy.

“Clearly, the issue of rising costs is a critical one that everyone is wrestling with in the health insurance business,” Marian Mulkey, project director for the California Health Care Foundation, told Psychiatric News.

She said the root causes of health care inflation have to do with continual expansion of what medicine can do for people in spite of limited resources to pay for those advances.

“We have all seen great advances in the types of care being offered, technology being used, and pharmaceuticals being marketed,” she said. “All these contribute to cost, as well as to quality and better outcome. The lesson for physicians is that there really aren’t easy solutions. Something simple like drawing a line on premiums doesn’t appear to be the solution.”

“Should California Regulate Health Insurance Premiums?” is posted online at www.chcf.org/documents/insurance/ShouldCARegulateHealthInsurancePremiums.pdf. ▪