Health Care Costs Overwhelm Many Who Have Insurance

Americans are accumulating household medical debt. Two new studies reveal that medical debt is a significant problem, even for those who have health insurance. The findings suggest that the ills of the American health care system are not confined to the margins of society.

A report last month in the journal Health Affairs stated that medical problems contribute to about half of all bankruptcies in the United States, with mental illness listed among the highest-cost diagnoses for those who listed medical causes for their bankruptcy. Mental illness accounted for about 10 percent of all bankruptcies, with a mean out-of-pocket expenditure of $15,478 incurred by debtors.

Meanwhile, the 2005 Commonwealth Fund Biennial Health Insurance Survey found that 8 of 10 people who have experienced problems with paying bills skip needed care because of the cost, and 2 of 5 with bill problems and debt have used up all or most of their savings.

Moreover, the trends toward consumer-driven health care and increased cost sharing in all types of health plans, as well as high-deductible health plans offered as part of health savings accounts, all appear likely to exacerbate the problem of medical debt, said Jennifer N. Edwards, Dr.P.H., director of health policy, research, and evaluation at the Commonwealth Fund.

“The cost sharing associated with high-deductible health plans can lead to under-utilization of services, and when you are sick is not the time to be shopping around for lower-price coverage,” Edwards said at a conference in Washington, D.C., in January sponsored by Families USA.“ The research to date shows that people can't distinguish between needed care and not-needed care. So when people have a financial incentive, they reduce all kinds of health care utilization, with adverse outcomes as a result.”

She presented data from the Commonwealth Fund's Biennial Health Insurance Survey, which surveys a nationally representative random sample of adults 19 and older living in the continental United States, with an oversampling of low-income, African-American, and Hispanic households. The Commonwealth Fund, located in New York, is a private foundation that supports independent research on health and social issues and makes grants to improve health care practice and policy.

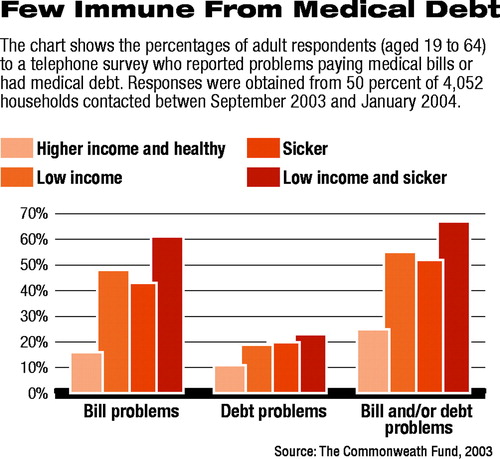

The Commonwealth Fund's insurance survey consisted of a 25-minute telephone interview conducted by the research and survey company PSRA International between September 2003 and January 2004. A total of 4,052 households were surveyed, with a response rate of 50 percent.

Survey participants were asked the following questions:

Survey participants who answered “no” to the previous questions were asked these two additional questions:

Do you currently have, or have you had in the past three years, any medical bills or medical debt that you couldn't pay right away and are paying off over time? | |||||

Have you had large credit card debt or had to take out a loan or debt against your home because you had to pay medical bills? | |||||

Edwards reported that the survey found 37 percent of respondents had problems with either medical bill or medical debt. Of those under age 65, 41 percent had bill or debt problems; of respondents over age 65, who were likely to be covered by Medicare, 17 percent reported bill or debt problems.

Adults with low incomes and those who were sicker had higher rates of medical bill problems and debt. Among those respondents classified as both low income (below 200 percent of the poverty level) and sicker (defined as fair or poor self-reported health status or having any chronic condition), 67 percent reported either bill or debt problems.

This compared with 55 percent of those who were low income but were not sicker, 52 percent of those who were sicker but not low income, and 25 percent of those who were healthy and higher income.

Edwards told participants at the conference that insurance clearly serves as a buffer to medical debt, but does not guarantee protection against debt. Of those in the survey reporting either medical debt or problems paying medical bills, 64 percent were insured at the time care was provided.

Of those reporting medical debt, 25 percent said their insurance had a deductible of over $500, while 40 percent reported that the plan did not pay for care they had expected it to pay for. Twenty-seven percent of the debtors reported that the plan had reached a yearly or lifetime limit, she said.

Some Forgo Care

The survey also found that an extraordinary number of people forgo recommended care. Of those survey respondents who reported being in medical debt and who were also continuously insured, 44 percent said they did not get needed care—defined as not filling a prescription, seeking a specialist, getting a recommended test, or visiting a doctor or clinic.

Among those in debt and who were uninsured all or part of the year, 79 percent said they did not get needed care, Edwards reported.

Of those respondents reporting either bill or debt problems, 44 percent said they had used all or most of their savings, and 27 percent were unable to pay for basic necessities such as food, heat, or rent.

Bankruptcy Linked to Medical Costs

The Health Affairs survey, widely reported by the lay press, similarly found a surprising burden of medical debt involved in the financial troubles of Americans.

Study authors David Himmelstein, M.D., and Steffie Woolhandler, M.D., surveyed 1,771 personal bankruptcy filers in five federal courts and completed in-depth interviews with 931 of them.

They reported that about half cited medical causes. Among those whose illnesses led to bankruptcy, out-of-pocket costs averaged $11,854 since the start of illness; 75.7 percent had insurance at the onset of illness. Medical debtors were 42 percent more likely than other debtors to experience lapses in coverage.

“The medical debtors we surveyed were demographically typical Americans who got sick,” the authors wrote. “They differed from others filing for bankruptcy in one important respect: They were more likely to have experienced a lapse in health coverage. Many had coverage at the onset of their illness but lost it. In other cases, even continuous coverage left families with ruinous medical bills.”

Himmelstein is an associate professor of medicine at Harvard Medical School and a primary care physician at Cambridge Hospital in Cambridge, Mass. Woolhandler is an associate professor of medicine at Harvard, where she codirects the General Medicine Faculty Development Fellowship Program. She practices primary care internal medicine at Cambridge Hospital.

The co-authors were Elizabeth Warren, who is the Leo Gottlieb Professor of Law at Harvard Law School in Boston, and Deborah Thorne, an assistant professor in the department of sociology and anthropology at Ohio University.

TheHealth Affairsstudy, “Illness and Injury as Contributors to Bankruptcy,” is posted online at<http://content.healthaffairs.org/cgi/content/abstract/hlthaff.w5.63>.▪