Surprising Amount of Public Funds Subsidizes U.S. Health Care

The American “privatized” health care system is heavily subsidized with public dollars.

More than half—56.1 percent—of all health care spending within the civilian noninstitutionalized population is accounted for by government spending, according to a study posted on July 29 in Health Affairs online.

Furthermore, public spending increased with poorer self-reported physical and mental health. Close to $12,000 in public dollars was spent per capita on people who reported being in poor mental health. That amount did not include spending on those receiving institutional care or who were active-duty military members.

But the study also found that the largest component of public spending is in the form of tax subsidies of all kinds—a hidden, or implicit, form of public support that is not typically included in health expenditure calculations, but which accounts for more than is spent on Medicare and Medicaid. Moreover, it represents a public benefit that is shared across income levels and physical and mental health status.

Lead author Thomas Selden, Ph.D., an economist with the Agency for Healthcare Research and Quality (AHRQ), said the finding is a valuable one as total health care spending is expected to approach $2.4 trillion in 2008 and as health system reform looms as an imperative for the next presidential administration.

“It is undeniable that we have a large public intervention in health care, and the question is how best to structure that,” Selden told Psychiatric News. “Do you tap into competitive market forces by offering subsidies, or do you go for direct public financing? However we resolve this, we are going to have a very large public involvement in health care.”

Selden and coauthor Merrile Sing, also of AHRQ, pooled data for 2002 and 2003 from the Medical Expenditure Panel Survey (MEPS), an annual household survey sponsored by the AHRQ, and the National Center for Health Statistics. MEPS is designed to yield nationally representative estimates of insurance coverage, medical spending, insurance premiums, and a wide range of other health-related and socioeconomic characteristics for people in the U.S. civilian, noninstitutionalized population.

To account for public outlays that are missing or underreported in MEPS, the data were aligned with information from the National Health Expenditures Account, produced by the Centers for Medicare and Medicaid Services. The report combines provider revenue estimates and administrative claims data to produce aggregate estimates of U.S. health spending by service type and payment source.

The authors also allocated Medicaid and Medicare disproportionate share payments and state and local funding for public hospitals using MEPS data on uncompensated care. Other estimates were made for spending on public health, research, and infrastructure.

Finally, they estimated a comprehensive array of tax expenditures at the household level, relying heavily on a model used by the National Bureau of Economic Research. As expected, the largest tax subsidy was from the exclusion of employer-sponsored insurance premiums for current workers from federal and state income taxation and from Social Security and Medicare payroll taxation. The second-largest component is the exemption of medical care from state and local sales taxes. Other tax expenditures include the medical-expense deduction, self-employed insurance premium deduction, the tax preference for retiree coverage, and other deductions.

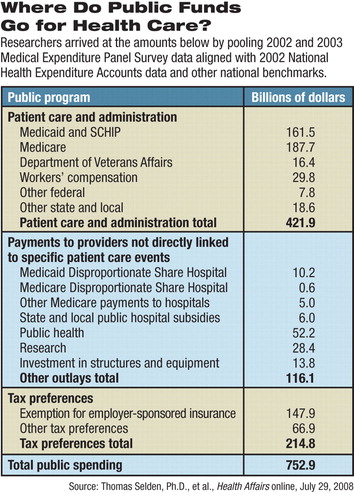

All told, there is a striking number of ways in which public dollars support American health care (see table), totaling an estimated $753 billion, more than half of the total health care spending for the U.S. civilian, noninstitutionalized population. Of that $753 billion, tax subsidies accounted for $214.8 billion, more than was spent by either Medicare or Medicaid.

Public spending averaged $2,612 per person in 2002 dollars. Tax subsidies averaged $745 per person, according to the report.

Not surprisingly, public spending on health was heavily targeted at those enrolled in public coverage, with spending for people receiving both Medicare and Medicaid averaging $12,859 per person. Public spending was also high on those with poorer self-reported health and mental health; just under 80 percent of all spending on people with poor self-reported mental health comes from public dollars, according to the report.

Somewhat more unexpected is the fact that even among people with private insurance, public spending accounted for 41.1 percent of total spending. Tax expenditures made up nearly two-thirds of this total, with most of the remainder explained by publicly funded uncompensated care and broadly targeted spending on research, public health, and investment.

“We think we are paying into this system and buying our coverage, but the public sector is picking up a large portion of the insurance premium,” Selden told Psychiatric News.

Again not unexpectedly, public spending was strongly related to age, with expenditures rising with age. Children aged 18 or under received $1,225 of public spending per capita, on average, which was less than one-fifth of average public spending for seniors over age 65 ($6,921).

More interesting is the dramatic difference between the two as a share of total spending: public spending was 10 percentage points higher for seniors as a share of total spending than for children. In fact, the public share for children was only 5.4 percentage points higher for children than for adults under age 65.

“We thought that was interesting in light of the large debate that has been going on over expansion or rollback in public coverage for children in the SCHIP programs,” Selden said in an interview. “There are two points here—one, children are far less expensive overall than seniors, and two, once you add everything up, the public commitment to paying for children's health care ends up being a lower share of total spending than that for seniors.

“It also dramatizes simply that a lot of public spending is going toward seniors. It's not a value judgment; it's just that it's a lot of money.”

“The Distribution of Public Spending for Health Care in the United States, 2002” is posted at<http://content.healthaffairs.org/cgi/content/full/hlthaff.27.5.w349/DC1>.▪